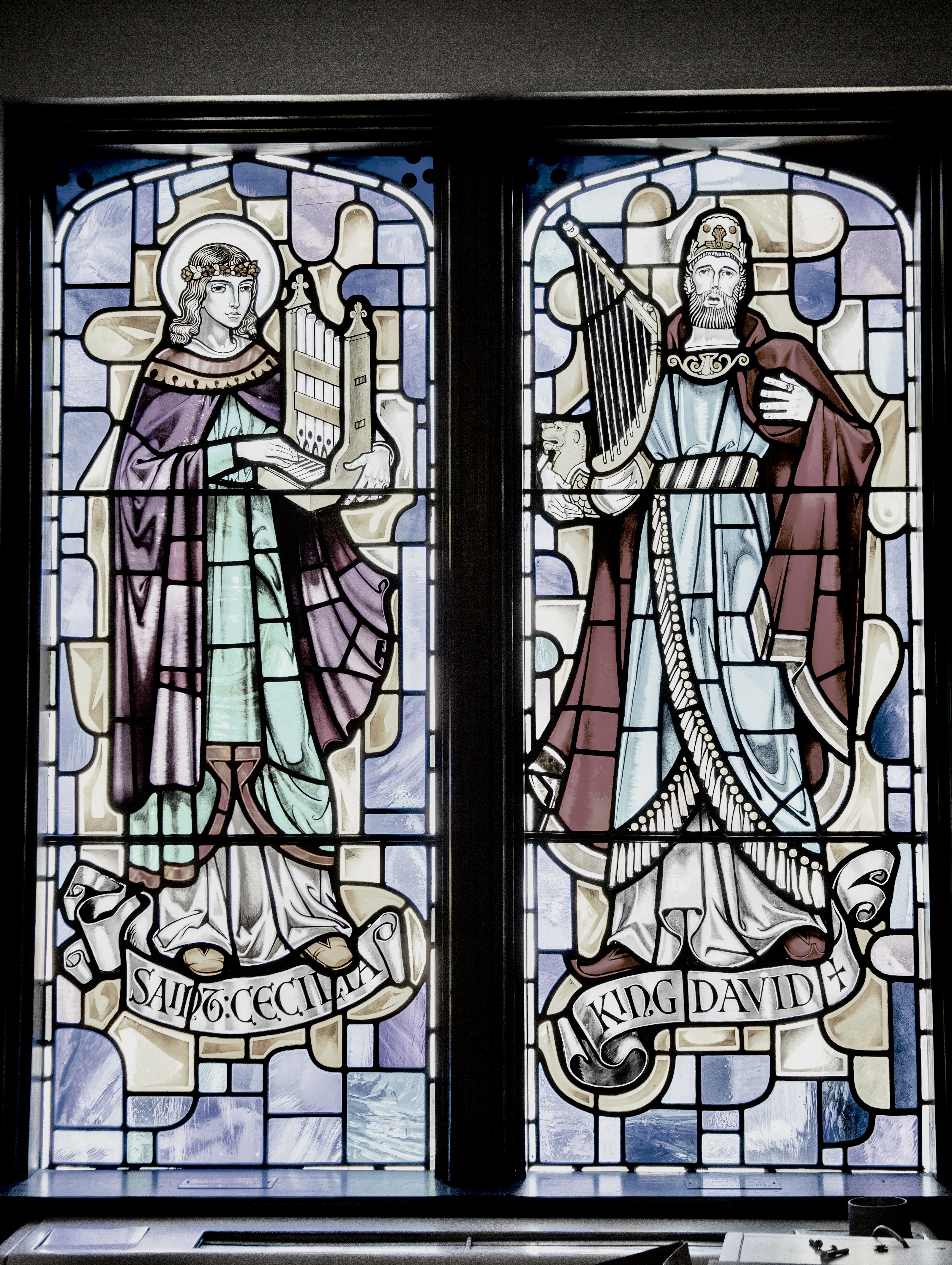

About the Foundation

Established in 1988, the mission of The Incarnation Foundation is to serve Jesus Christ and his church by supporting the mission, ministries, identity, and vision of the Episcopal Church of the Incarnation through the effective management of its permanent assets and unrestricted funds, the development of endowed funds, and the responsible distribution of income from these funds.

Every member of our church family has an opportunity to build on Incarnation’s exceptional history by making a planned gift. By doing so, you join the generational impact of the church’s mission and ministry in the world.

Whatever approach you choose, your gift will honor the vision of Incarnation’s founder, the Rt. Rev. Alexander Charles Garrett, as we grow God’s kingdom and ensure a future filled with hope — one that declares God’s faithfulness to all generations, always and forever.

We invite you to join with us.